History command #

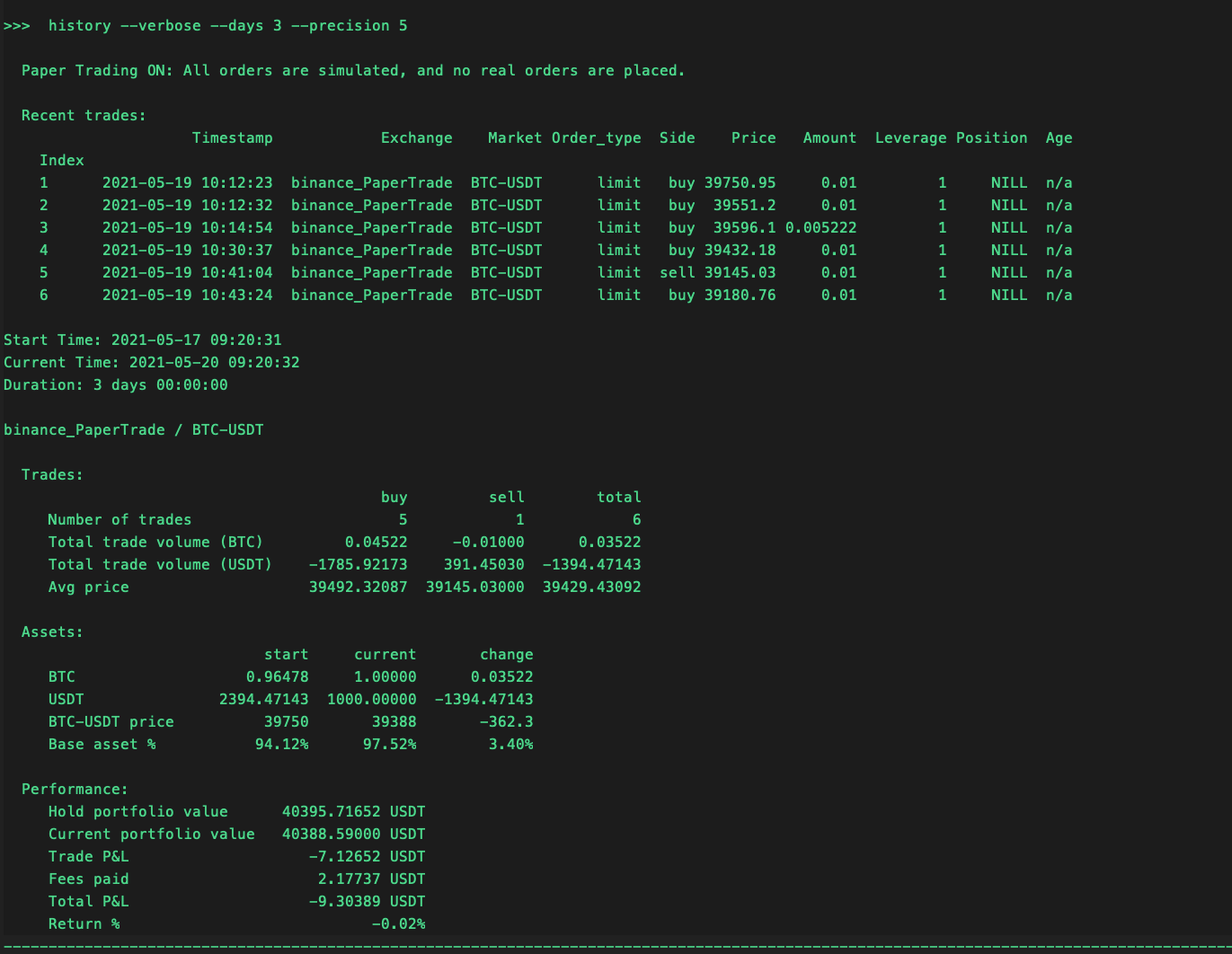

The history command displays the current duration of total past trades, asset inventory and value, and market trading pair performance. Run history --verbose to see all recent trades.

Trades are saved locally in a .csv file located in the data folder which you can view by running history --verbose --days command even after you restart Nonstop Algo.

Optional argument --precision specifies the number of decimal values.

This block below shows the calculation for some of the values displayed in the history output.

Avg price = total trade volume of quote / total trade volume of base asset

Hold portfolio value = (base start asset * current market price) + quote start asset

Current portfolio value = (base current asset * current market price) + quote current asset

Trade P&L = current portfolio value - hold portfolio value

Total P&L = trade P&L + fees paid

Return % = total P&L / hold portfolio value

Tip

The Return % in the navbar at the bottom of Nonstop Algo client may be different from the history command output. This is because the Return % in history takes the price changes into calculation while the navbar in the bottom UI does not.

How It Works #

Run the history command in Nonstop Algo to display the current duration of total past trades, asset inventory and value, market trading pair performance.

Sample Output #

>>> history

Start Time: 2020-11-11 00:56:37

Current Time: 2020-11-11 12:57:22

Duration: 0 days 12:00:45

binance / MFT-BNB

Trades:

buy sell total

Number of trades 113 97 209

Total trade volume (BTC) 2181335 -2133912 47423

Total trade volume (USDT) -217,67 210.76 -6.91

Avg price 0.0000998 0.0000988 0.0001457

Assets:

Start Current Change

MFT 155248 202671 47423

BNB 23.331 16.419 -6.912

MFT/BNB price 0.0001076 0.0000809 -0.0000267

Base asset % 41.7% 50.0% 8.2%

Performance:

Hold portfolio value 35.890 BNB

Current portfolio value 32.815 BNB

Trade P&L -3.075 BNB

Fees paid -0.428 BNB

Total P&L -3.504 BNB

Return %: -9.76%

The following displays the formula for key calculations:

Note

For more details on the calculations, please see this Google Sheet.

Average Price #

Avg Price = Total trade volume of quote/Total trade volume of base asset.

In the sample output, the total avg price is 6.91/47423 = 0.0001457

This value means the average price of total MFT/BNB trades is 0.0001457

Hold Portfolio Value #

The asset value from the start to the end with no trades.

Hold portfolio value = (base start asset*current market price)+ quote start asset

From the above example, for the Hold portfolio value is (155248*0.0000809)+23.33=35.89

Current Portfolio Value #

Current portfolio value = (base current asset*current market price)+ quote current asset

From the above example, for the Current portfolio value is (202671*0.0000809)+16.419=32.815

Trade P&L #

Trade P&L = Current portfolio value – Hold Portfolio value

From the above example, for the Trade P&L value is 32.815-35.89=-3.075

Total P&L #

Total P&L = Trade P&L + Fees paid

From the above example, for the Total P&L is -3.075 + -0.428 = -3.504

Return Percentage #

Return% = Total P&L/Hold portfolio value

From the above example, for the Return% is -3.075/-35.89 = -9.76%

The Return % (bottom navbar) matches the calculated return on History after the last trade, see following screenshot: