Dex Strategy

Note

This is a proof-of-concept strategy that demonstrates how to dynamically maintain Uniswap-V3 positions as market prices changes. More features will be added over time based on community feedback.

📝 Summary #

This strategy creates and maintains Uniswap positions as the market price changes in order to continue providing liquidity. Currently, it does not remove or update positions.

🏦 Exchanges supported #

uniswap-v3

🛠️ Strategy configs #

| Parameter | Type | Default | Prompt New? | Prompt |

|---|---|---|---|---|

market | string | True | Enter the trading pair you would like to provide liquidity on [connector] | |

fee_tier | string | True | On which fee tier do you want to provide liquidity on? (LOW/MEDIUM/HIGH) | |

buy_spread | decimal | 1.00 | True | How far away from the mid price do you want to place the buy position? (Enter 1 to indicate 1%) |

sell_spread | decimal | 1.00 | True | How far away from the mid price do you want to place the sell position? (Enter 1 to indicate 1%) |

base_token_amount | decimal | True | How much of your base token do you want to use for the buy position? | |

quote_token_amount | decimal | True | How much of your quote token do you want to use for the sell position? | |

min_profitability | decimal | True | What is the minimum profitability for each position is be adjusted? (Enter 1 to indicate 1%) | |

use_volatility | bool | False | False | Do you want to use price volatility to adjust spreads? (Yes/No) |

volatility_period | int | 1 | False | Enter how long (in hours) do you want to use for price volatility calculation |

volatility_factor | decimal | 1.00 | False | Enter the multiplier applied to price volatility |

📓 Description #

Approximation only

The description below is a general approximation of this strategy. Please inspect the strategy code in Trading Logic above to understand exactly how it works.

Starting #

- The bot will look for information about the pool, and if it is a valid pool. If the pool doesn’t exist, warn the user and stop the strategy

- Fetch the current mid price of the pool (

last_price) - If

use_volatilityis True, the bot will calculate the price volatility used to widen spreads - If the pool is valid, the bot will create two starting positions:

- The SELL position with:

- Amount of tokens added to the position =

base_token_amount upper_price=(1 + sell_spread) * last_pricelower_price=last_price

- Amount of tokens added to the position =

- The BUY position with:

- Amount of tokens added to the position =

quote_token_amount upper_price=last_pricelower_price=(1 - buy_spread) * last_price

- Amount of tokens added to the position =

- The SELL position with:

The bot maintains a variable total_position_range that defines the total price range, comprised of upper_price and lower_price, where the bot is providing liquidity.

Running #

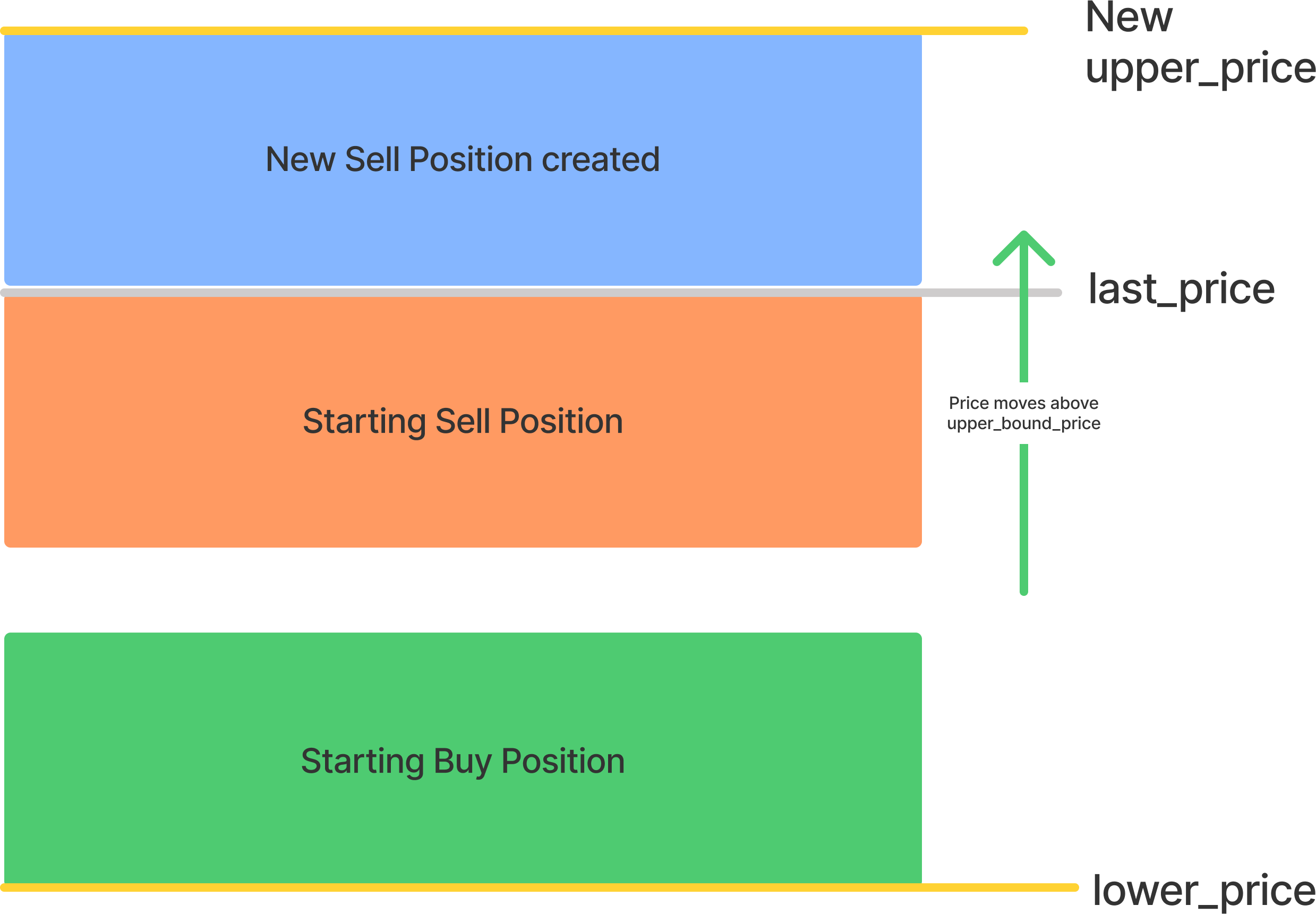

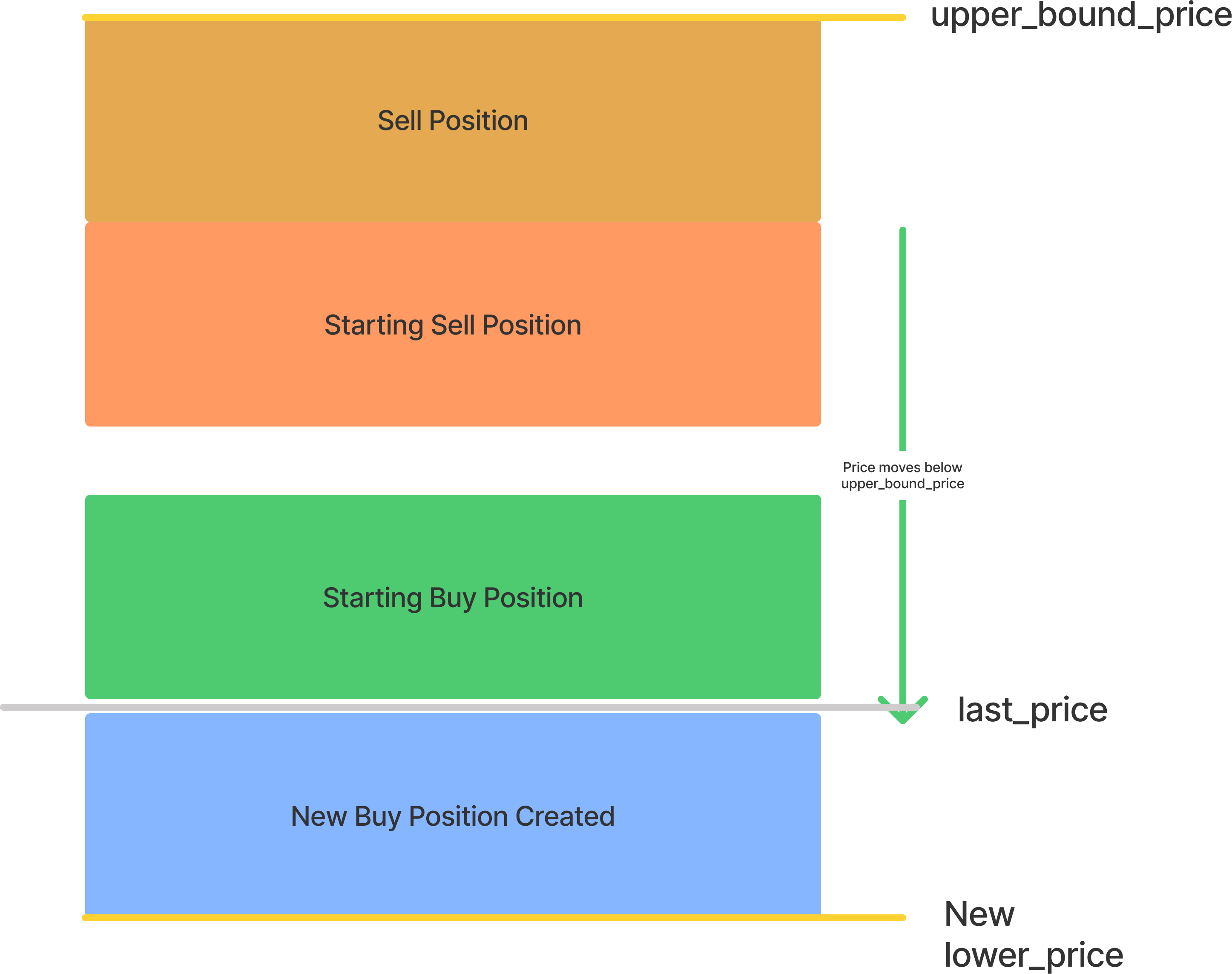

Each tick, the bot monitors the pool mid price (last_price) and compare it to the bounds of total_position_range. It will adjust the position under the following scenarios:

last_price is higher than upper_price of total_position_range

- Create a new SELL liquidity position, using the following values:

- Amount of tokens of the new position =

base_token_amount - Top price bound =

(1 + sell_spread) * last_price - Lower price bound =

last_price

- Amount of tokens of the new position =

- Update

total_position_range:upper_price = (1 + sell_spread) * last_price

last_price is lower than lower_price of total_position_range

- Create a new BUY liquidity position, using the following values:

- Amount of tokens of the new position =

quote_token_amount - New position upper price =

last_price - New position lower price =

(1 - buy_spread) * last_price

- Amount of tokens of the new position =

- Update

total_position_range:lower_price = (1 - buy_spread) * last_price

Important Notes #

- Currently, the strategy does not remove existing positions. The user should do it manually through the Uniswap interace (https://app.uniswap.org/#/pool).

- The

statuscommand shows the current profitability of each position, using thequoteasset as reference